Global economic growth is expected to have increased during Q3 2024, driven by the continued recovery in advanced economies and strong performance in emerging markets, though short-term prospects continue to be undermined by still-high interest rates, a potential cooling of labor markets and growing political uncertainty. Inflation continued to ease, with the Consumer Price Index (CPI) continuing to moderate while the annual core inflation rate remained steady. This decline in inflation provided the Federal Reserve room to start easing its monetary policy, finally lowering interest rates by 50 basis points on September 18, 2024. The labor market showed signs of stabilization, with higher unemployment mostly attributed to an increase in labor supply.

Geopolitics continued to be dominated by 4 themes:

- Middle East conflict: Geopolitical tensions in the Middle East continued to cause oil price volatility, with Brent crude prices fluctuating between $70-$80 per barrel. These conflicts had a significant impact on global energy markets and investor sentiments.

- U.S.-China trade relations: Trade tensions between the U.S. and China remained elevated, affecting global supply chains and trade flows. The ongoing strain in U.S.-China relations led to a decline in orders from Asia, particularly impacting the semiconductor industry.

- Russia-Ukraine War: The conflict in Eastern Europe continued to influence European markets, with the Euro Stoxx 50 index experiencing fluctuations due to geopolitical uncertainties. Investors remained cautious, with a focus on de-risking portfolios in anticipation of policy uncertainties.

- U.S. political landscape: The upcoming U.S. elections added to geopolitical uncertainties, with potential shifts in ruling parties likely to have immediate geopolitical implications. Investors were advised to overweight U.S. assets and maintain a cautious approach.

Overall, Q3 2024 was marked by a mix of economic recovery and geopolitical challenges. While inflation showed signs of easing and the labor market stabilized, geopolitical tensions continued to create uncertainties in global markets. Investors have been challenged to navigate these complexities with a focus on diversification and risk management.

As we look again at the four scenarios which we believe could unfold:

- The “soft-landing” which the Fed is looking to engineer, stayed in the foreground as inflation continued to moderate and labor markets stabilized;

- A “hard landing”, which would quickly bring the recession that has eluded many economists, seems less likely as economic indicators stabilized;

- “Stagflation” where inflation is persistent, causing the Fed to keep rates elevated at the cost of economic growth, seems unlikely as the Federal Reserve launched the start of an easing cycle by lowering interest rates;

- The Fed tolerates “higher inflation” for a while, so as to not sacrifice growth and full employment, seems less likely as inflation continued its disinflationary path.

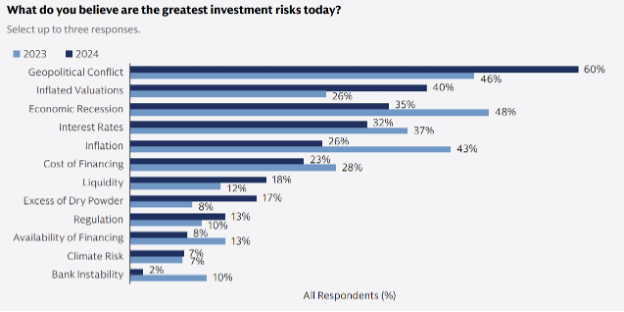

It is interesting to note that with expectations focusing once more on a soft-landing scenario, market participants’ worries have shifted away from recession and inflation risk to geopolitical and inflated valuations risk, as illustrated by the chart below.

Source: Goldman Sachs Asset Management, 2024 Private Markets Diagnostic Survey

We find that missing from this chart is the risk posed by the swelling U.S. budget deficit. As we mentioned in our previous commentary, the U.S. budget deficit for FY 2024 is projected to be $1.9 trillion, which is equivalent to 6.7% of GDP. This is a significant increase from previous years and highlights the ongoing fiscal challenges. The cost of servicing the U.S. debt is currently $1.049 trillion, which accounts for 17% of total federal spending. This cost has been rising steadily and is a major concern for policymakers due to its impact on the overall budget. Market participants have so far seemed to focus on the upcoming U.S. elections, but there is little doubt that the deteriorating budget deficit will come back in full focus as the winning candidate looks to unveil their economic plan, adding to the uncertainty and risk facing capital markets.

During the third quarter of 2024, the Magnificent Seven (Nvidia, Apple, Microsoft, Alphabet, Tesla, Meta and Amazon) underperformed the broader index for the first time since the final quarter of 2022, yet the S&P 500 TR index finished the quarter up 5.9%, as the rally spread to the broader market. This is a healthy development, but it is accompanied by a market shift in investor sentiment regarding inflated valuations.

Similarly, bonds had a good quarter, with the Bloomberg US Aggregate Bond TR Index up 5.2%.

Inversely, diversifying strategies such as commodities and CTA/managed futures had a tough quarter, giving back some of their early gains in the year. While this performance is disappointing, it is worth noting that such losses are normal in a portfolio of uncorrelated assets, and should be expected from time to time. Investors need to focus on the long-term benefits of including risk mitigating strategies instead of the occasional bump in the road.

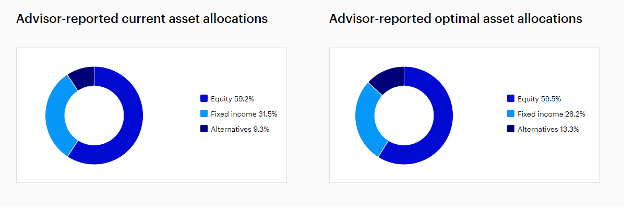

We recently published an article that examines the addition of such risk mitigating strategies in portfolios. The article can be found here: Fixing the 40: Reassembling the 60/40 Portfolio. Interestingly, research from Cerulli Associates, in partnership with the Investments & Wealth Institute, shows that advisors have been looking to increase their allocations to alternative, as detailed by the graph below.

Source: Cerulli Research

We look forward to discussing any questions you may have.

| Benchmark | Q3’2024 | Year-to-Date |

| S&P 500 TR | 5.9% | 20.7% |

| Bloomberg US Aggregate Bond TR Index | 5.2% | 4.5% |

| S&P GSCI TR | -5.3% | 5.8% |

| US Dollar Index | -3.9% | 0.9% |

| SG CTA Index | -4.4% | 3.0% |

| SG Trend Index | -5.9% | -3.2% |

| SG STTI | -0.5% | -0.7% |

For further information about the Galaxy Plus managed account platform, please contact: Marc Lorin, CIO, (630) 566-4521, mlorin@galaxyplus.io.

About Galaxy Plus:

Galaxy Plus is a managed account platform for managers and investors providing an institutional level, “managed account like” experience in alternative assets. The Galaxy Plus Platform is an innovative solution with a flexible structure, increased efficiency, lower costs, increased risk mitigation, and a highly controlled and secure infrastructure.

IMPORTANT DISCLAIMERS:

The author’s point of view reflected in this article should not be construed as investment advice. The CTA strategies noted herein, some of which may be available on the Galaxy Plus platform, do not represent an endorsement of a particular CTA or strategy. The information presented is for illustrative purposes only and is based on the opinion of the author as a result of recent market conditions and does not represent the view of New Hyde Park Alternative Funds, LLC.

AN INVESTMENT IN ANY FUND IS SPECULATIVE AND INVOLVES A HIGH DEGREE OF RISK. THE PAST RESULTS OF A FUND AND/OR ITS TRADING ADVISOR ARE NOT INDICATIVE OF HOW SUCH FUND WILL PERFORM IN THE FUTURE. 3492-NHPAF-10232024