The S&P 500 TR index finished the year up over 25%, with the rally spreading to the broader markets. The Bloomberg US Aggregate Bond TR Index also had strong performance, up 1.3% for the year. Commodities and CTA/managed futures strategies faced challenges, giving back some of their early gains.

Steady But Uneven Global Economic Growth

The US economy continued its steady growth into Q4 2024, with GDP growth reaching 3.1% in Q3, above the initial consensus expectation of 2.8%. Other advanced economies showed mixed results with the Eurozone gradually recovering. Emerging markets maintained solid growth, though China’s growth outlook improved slightly due to a new stimulus push. Labor markets remained strong, with unemployment rates nearing multi-decade lows. However, there were signs of a slight increase in unemployment in some countries, which is attributed to a return to pre-pandemic trends.

The Last Mile on Reducing Inflation Proves Difficult

Overall, global inflation continued to ease. The U.S. saw a significant reduction in inflation throughout 2024. This easing of inflation allowed central banks to further loosen monetary policies, with the U.S. Federal Reserve cutting rates by an additional 25 basis points in both November & December, bringing the total to 100 bps for the year. However, recent inflation readings remain stubbornly above the Fed’s 2% target.

Moreover, President Trump’s policies could potentially stoke inflation through several mechanisms:

- Tariffs: Trump has proposed aggressive tariffs on imports from countries like China, Mexico, and Canada. These tariffs could increase the cost of imported goods, leading to higher prices for consumers.

- Immigration Policies: Trump’s plans for mass deportations could lead to labor shortages in industries that rely heavily on immigrant workers, such as agriculture and construction. This could drive up wages in those sectors, contributing to overall inflation.

- Tax Cuts: Trump’s proposed tax cuts could boost consumer spending by increasing disposable income. While this might stimulate economic growth, it could also lead to higher demand for goods and services, pushing up prices.

- Energy Policies: Increasing domestic oil and gas production might lower energy costs in the long run, but the immediate impact of policy changes could create volatility in energy prices. This volatility can contribute to inflation, especially if energy costs rise.

- Government Spending: Trump’s policies could lead to increased government spending, particularly on infrastructure projects. While this might boost economic growth, it could also increase the federal deficit and put upward pressure on inflation.

Overall, while some of the incoming U.S. administration’s policies might aim to stimulate economic growth, they could also create inflationary pressures through higher costs for goods, labor, and energy. This complex interplay of factors makes it challenging to predict the exact impact on inflation, and, while still too early to assess, the potential for increased prices is a significant concern for policymakers and consumers alike.

It is interesting to note that every major inflation cycle since the early 1900’s has occurred with more than one wave, as depicted in the chart below. Are we witnessing the start of a second wave of inflation?

Source: New Hyde Park Alternative Funds; FRED

Increasing Yield on US Treasuries Is a Warning

The yield on U.S. 10-year Treasury notes increased from 3.787% to 4.576% in Q4 2024 due to several factors:

- Inflation Concerns: The Federal Reserve’s minutes from its latest meeting indicated greater concern over inflation. Investors interpreted this as a signal that the Fed might slow down its rate-cutting cycle. In addition, rising long-term inflation expectations also played a role, as investors demanded higher yields to compensate for the anticipated erosion of purchasing power.

- Strong Economic Data: Positive economic data, such as higher-than-expected job openings and private sector job creation, boosted investor confidence in the economy. This increased demand for higher returns, pushing yields up.

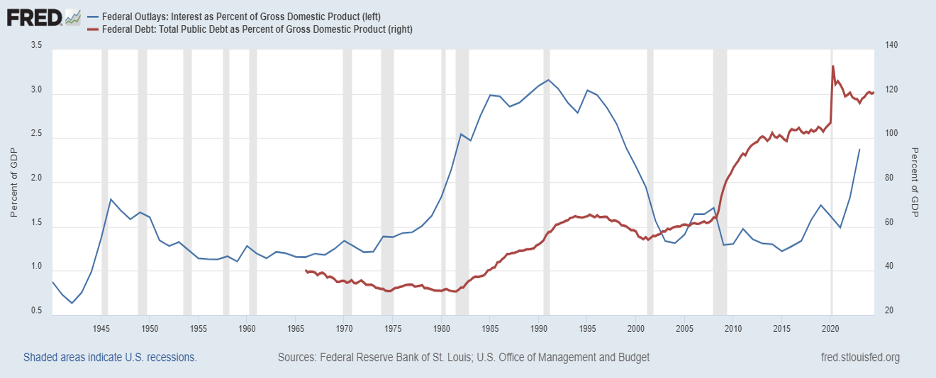

- Fiscal Spending: The U.S. government’s fiscal expansion, including increased spending and potential tax cuts, led to higher budget deficits, leading to frictions about the budget deficit ceiling. To finance these deficits, the Treasury issued more debt, increasing the supply of Treasuries and driving yields higher. As we have mentioned in the past, note that not only is the budget deficit increasing, but also the associated cost of financing it, leading to a sharp increase in the cost of servicing the debt, as depicted in the chart below. The cost of servicing the debt is now the potential of crowding out defense spending.

Source: FRED

- Quantitative Tightening: The Federal Reserve’s ongoing quantitative tightening reduced demand for Treasuries, further contributing to higher yields.

These factors combined to push the yield on the 10-year Treasury note to its highest level since April 2024. Many will question why long-term rates are rising when the US FOMC is in the midst of an easing cycle.

Geopolitical Developments Remain Challenging

Q4 2024 continued to be marked by significant geopolitical events. The U.S. presidential election saw Donald Trump winning the presidency, signaling a shift towards more isolationist policies. The Russia-Ukraine conflict escalated, with Ukraine continuing its incursion into Kursk and Russia advancing in Donetsk. The Middle East saw ongoing conflicts, contributing to oil price volatility. Last, the China/Taiwan rhetoric continued to be a concern.

Pricing For Goldilocks

Recently, Federal Reserve Governor Lisa Cook provided a warning reminiscent of former Chair Alan Greenspan’s famous 1996 “irrational exuberance” speech:

“Valuations are elevated in a number of asset classes, including equity and corporate debt markets, where estimated risk premia are near the bottom of their historical distributions, suggesting that markets may be priced to perfection and, therefore, susceptible to large declines, which could result from bad economic news or a change in investor sentiment,” Governor Cook said.

2025 Outlook and Need to Recalibrate Investment Portfolios

As we look again at the four scenarios which we believe could unfold:

- The “soft-landing”, which the Fed is looking to engineer, took a step back as inflation continues to be sticky, but still seems the likely scenario. Some will question how long the runway really is;

- The Fed tolerating “higher inflation” for a while as to not sacrifice growth and full employment, gained ground with the Fed continuing to ease, but with bond vigilantes warning the Fed of the potential impact of its policy on the long end of the curve;

- “Stagflation” where inflation is persistent causing the Fed to keep rates elevated at the cost of economic growth, still seems unlikely as the Federal Reserve continued easing monetary policy, but could quickly gain ground with the new White House administration;

- A “hard landing”, which would quickly bring the recession that has eluded many economists, seems less likely as economic indicators haven’t deteriorated.

The 2025 outlook for equity markets is unclear. Lofty valuations and a high concentration point to lower future returns, but at the same time current leverage of S&P 500 companies blunts some of the risk presented by these high valuations.

On the other hand, fixed income markets look much more vulnerable with credit spreads being extremely tight. The long end of the curve is presenting higher rates, a sign of market concern due to the associated costs of large deficits. This remains a concern for traditional investors targeting a 60% stocks/40% bonds portfolio allocation. Also, with inflation still a concern, the risk posed by positive correlation between these two assets classes effectively nulls the expected diversification.

As they navigate new realities, investors must continue to focus on diversification and risk management, including considering an increased allocation to alternative assets, in particular risk mitigating strategies. The renewed volatility & dispersion of returns across various assets bodes well for hedge fund strategies, including managed futures. Due to their convexity, these types of strategies may be valuable when building portable alpha portfolios to complement traditional assets.

At the very least, investors should consider the replacement of some of their traditional holdings with risk mitigating strategies. As we point out in an article (link: Fixing the 40: Reassembling the 60/40 Portfolio), the addition of such strategies may provide the necessary diversification during difficult parts of the economic cycle, such as inflationary periods.

We would welcome a discussion about your needs for portfolio diversification. Feel free to reach out to us at the contact details below.

| Benchmark | Q4’2024 | Year-to-Date |

| S&P 500 TR | 2.4% | 25.0% |

| Bloomberg US Aggregate Bond TR Index | -3.1% | 1.3% |

| S&P GSCI TR | 3.8% | 9.3% |

| US Dollar Index | 7.7% | 8.0% |

| SG CTA Index | -4.5% | 2.4% |

| SG Trend Index | 0.3% | 2.6% |

| SG STTI | -0.5% | 0.2% |

For further information about the Galaxy Plus Managed Account Platform, please contact:

Marc Lorin, CIO, (630) 410-1859, mlorin@galaxyplus.io

About Galaxy Plus:

Galaxy Plus is a managed account platform for managers and investors providing an institutional level, “managed account like” experience in alternative assets. The Galaxy Plus Platform is an innovative solution with a flexible structure, increased efficiency, lower costs, increased risk mitigation, and a highly controlled and secure infrastructure.

IMPORTANT DISCLAIMERS:

The author’s point of view reflected in this article should not be construed as investment advice. The CTA strategies noted herein, some of which may be available on the Galaxy Plus platform, do not represent an endorsement of a particular CTA or strategy. The information presented is for illustrative purposes only and is based on the opinion of the author as a result of recent market conditions and does not represent the view of New Hyde Park Alternative Funds, LLC.

AN INVESTMENT IN ANY FUND IS SPECULATIVE AND INVOLVES A HIGH DEGREE OF RISK. THE PAST RESULTS OF A FUND AND/OR ITS TRADING ADVISOR ARE NOT INDICATIVE OF HOW SUCH FUND WILL PERFORM IN THE FUTURE. 3505-NHPAF-01172025