2023 saw the turnarounds of both stocks and bonds. By the end of the year, the 60/40 portfolio had almost recovered from one of its deepest drawdowns. In contrast, the year proved to be a difficult year for CTAs. In hindsight, 2022-2023 mirrored a lot of what happened in 2008-2009: equity markets staged a recovery following a drawdown period. As equity markets recovered, volatility dropped throughout the year. Volatility also dropped in other asset classes as supply chains continued to improve and the energy crisis caused by the war in Ukraine in 2022 abated. A commercial real estate market challenged by much higher interest rates, a bank crisis that saw 3 of the 5 largest US bank failures in history, an ongoing war in Europe and a new war in the Middle East were not enough of a catalyst to durably disrupt markets. This declining volatility environment across all the asset classes was a difficult environment for strategies that provide convexity. After an impressive 20% gain in 2022, SG CTA Index posted a 3.5% decline in 2023.

The four scenarios which looked probable at the beginning of 2023 still look relevant today:

- The “soft-landing” the Fed is looking to engineer, and is the current prevalent scenario as inflation has moderated without damaging economic growth;

- A “hard landing”, which would quickly bring the recession that has eluded many economists, seems less likely than it did at the beginning of 2023;

- “Stagflation” where inflation is persistent, causing the Fed to keep rates elevated at the cost of economic growth, seems unlikely with the recent progress on the inflation front;

- The Fed tolerates “higher inflation” for a while so as to not sacrifice growth and full employment is a scenario that is still likely if a second wave of inflation materializes as has often been the case during previous inflation cycles.

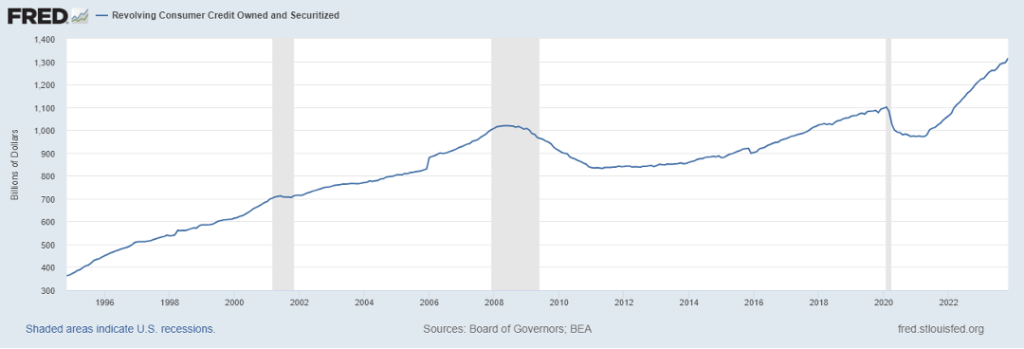

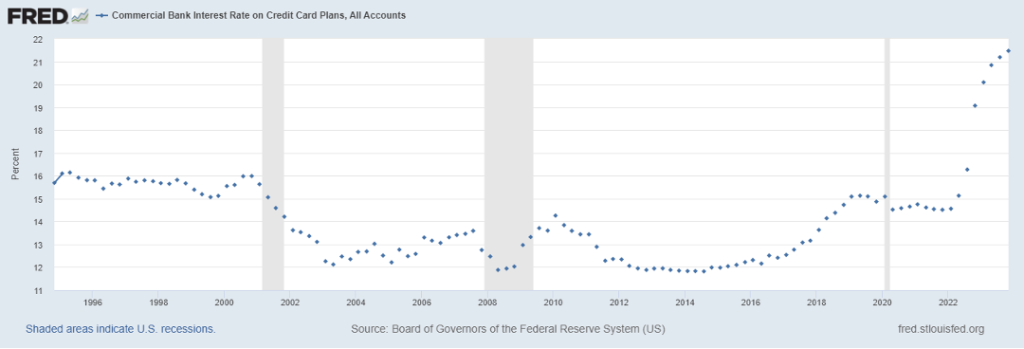

While US consumers show no sign of abating consumption, they have now reached a level of indebtedness that, combined with higher credit card rates, could prove to be a headwind. This is similar to the situation we were describing last quarter with the US total public debt.

Source: https://fred.stlouisfed.org

Source: https://fred.stlouisfed.org

Q4’23 was very eventful. After 10-year US Treasury yields crossed 5% for the first time since July 2007, a rally in the bond market in mid-October caught many market participants by surprise and eventually spilled over to the stock market going into a historic rally of its own. As the new year starts, it is worth noting that 2024 is not just a US election year but as Time Magazine notes “it’s perhaps the election year” with national elections in 64 countries plus the European Union which, as noted by The New York Times, represent half of the world’s population.

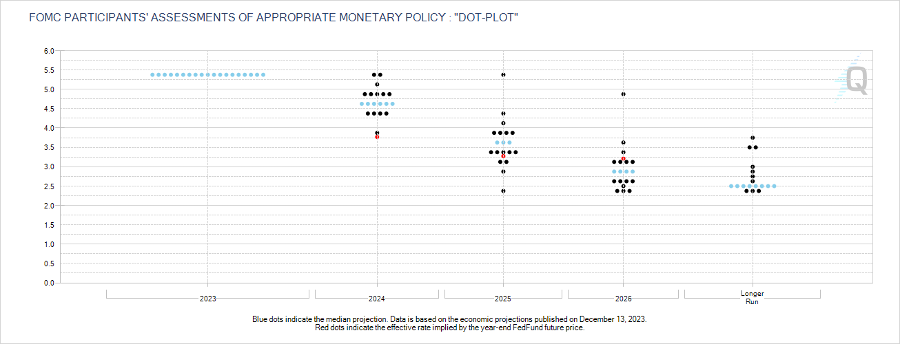

Of course, with 2024 being an election year, it is likely that the US Federal Reserve will accept taking more risk on the inflation front to support the economy with an easier monetary policy in an attempt to appear neutral, but also mirroring the progress made so far on the inflation front. As such, market participants now expect the Fed Funds rate to decrease below 4%, as illustrated by the following chart.

Source: CME Group

In this potentially volatile global macro environment, we continue to advocate investors to be vigilant and to run a well-diversified portfolio of risk assets and risk-mitigating strategies like macro and CTA strategies which may help navigate the future uncertainty and mitigate any potential resurgence of volatility.

The NHPAF team wishes you a happy and healthy New Year. We greatly appreciate all your support, and we hope for a prosperous 2024 alongside you.

For further information about the Galaxy Plus managed account platform, please contact: Marc Lorin, CIO, (630) 566-4521, mlorin@galaxyplus.io.

About Galaxy Plus:

Galaxy Plus is a managed account platform for managers and investors providing an institutional level, “managed account like” experience in alternative assets. The Galaxy Plus Platform is an innovative solution with a flexible structure, increased efficiency, lower costs, increased risk mitigation, and a highly controlled and secure infrastructure.

IMPORTANT DISCLAIMERS:

The author’s point of view reflected in this article should not be construed as investment advice. The CTA strategies noted herein, some of which may be available on the Galaxy Plus platform, do not represent an endorsement of a particular CTA or strategy. The information presented is for illustrative purposes only and is based on the opinion of the author as a result of recent market conditions and does not represent the view of New Hyde Park Alternative Funds, LLC.

AN INVESTMENT IN ANY FUND IS SPECULATIVE AND INVOLVES A HIGH DEGREE OF RISK. THE PAST RESULTS OF A FUND AND/OR ITS TRADING ADVISOR ARE NOT INDICATIVE OF HOW SUCH FUND WILL PERFORM IN THE FUTURE.

3443-NHPAF-01242024