Artificial intelligence continued to propel stocks higher, bringing the S&P 500 TR Index up 15.3% YTD. Chip maker Nvidia even briefly became the world’s highest-valued listed company in June.

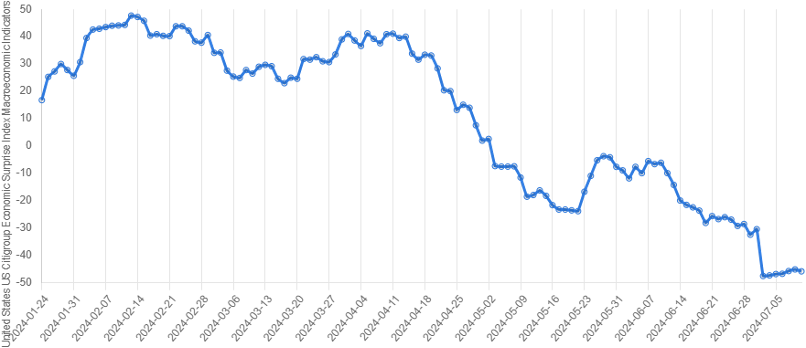

While during the first half of Q2, markets continued to price out an easing from the Fed due to continued fears of inflation, the situation turned around during the second half as indicators of inflation started showing signs of softening alongside stable to softening economic growth. While GDP growth eased substantially, the labor market remained resilient, with the U.S. unemployment rate moderately increasing to 3.9%. Gainfully employed workers continued spending with only a slight pullback in consumer spending. There seems to be a trend towards softer economic data going forward with U.S. data surprising to the downside as evidenced by the U.S. Citigroup Economic Surprise Index which went negative.

Source: CitiGroup

As we look again at the four scenarios which we believe may unfold:

- The “soft-landing”, which the Fed is looking to engineer, came back to the foreground as disinflation resumed with a softening of economic growth;

- A “hard landing”, which would quickly bring the recession that has eluded many economists, seems less likely as economic indicators aren’t exhibiting a significant degradation;

- “Stagflation” where inflation is persistent, causing the Fed to keep rates elevated at the cost of economic growth, seems unlikely even when considering the stubbornness of the Federal Reserve to finish the job on inflation;

- The Fed tolerates “higher inflation” for a while, so as to not sacrifice growth and full employment, is a scenario that, after increasing in likelihood during Q1, now seems less likely as inflation resumed its disinflationary path.

However, following the performance of Joe Biden during the Presidential debate at the end of June, the Trump Train returned in full force. Whereas neither candidate had a clear advantage before the debate, post-debate polls have made it apparent that the Democratic incumbent lost ground to his Republican challenger. Trump’s purported economic plans include new tariffs and tax cuts, which could rekindle inflationary forces, making the job of the Federal Reserve harder. The U.S. election cycle will most likely dominate the spotlight going into November, possibly resulting in a shift in trading focus as market participants react to the potential shift in policies.

Complicating the outlook, the nonpartisan Congressional Budget Office projected that the budget deficit is set to widen by $1.9 trillion this year, before nearing $2.9 trillion in 2034. That would almost double the debt held by the public, from $28 trillion to $50 trillion over the same period. As the debt grows, so does the risk of a debt crisis brought on by a loss of investor confidence.

With the S&P 500 Index having returned over 100% over the last 5 years, it is logical for investors to express skepticism towards the bedrock investment principle that is diversification. Even the other component of the 60/40 portfolio, bonds, as expressed by the Bloomberg US Aggregate Bond Index, has lost money over the same period, highlighting the challenges caused by inflation to that portfolio. However, we continue to advocate for investors to be vigilant, not give up on diversification, and in fact broaden their diversification to include risk-mitigating strategies like managed futures. These types of strategies have historically proven that they can help mitigate the uncertainty in risk-assets portfolios.

We recently published an article that examines the addition of such strategies in portfolios. In the article, we make the argument to add managed futures in place of a portion of the bond allocation in the traditional 60/40 portfolio. Managed futures can be a strong diversifier to the 60/40 portfolio and help navigate any of the aforementioned economic scenarios, especially related to inflation. The article can be found here: Fixing the 40: Reassembling the 60/40 Portfolio. We look forward to discussing any questions you may have.

| Benchmark | Q2’2024 | Year-to-Date |

| S&P 500 TR | 10.6% | 15.3% |

| Bloomberg US Aggregate Bond Index | -0.8% | -0.2% |

| S&P GSCI TR | 10.4% | 11.1% |

| US Dollar Index | 2.7% | 3.7% |

| SG CTA Index | -2.2% | 7.2% |

| SG Trend Index | -3.2% | 8.6% |

| SG STTI | -0.2% | 0.9% |

For further information about the Galaxy Plus managed account platform, please contact: Marc Lorin, CIO, (630) 566-4521, mlorin@galaxyplus.io.

About Galaxy Plus:

Galaxy Plus is a managed account platform for managers and investors providing an institutional level, “managed account like” experience in alternative assets. The Galaxy Plus Platform is an innovative solution with a flexible structure, increased efficiency, lower costs, increased risk mitigation, and a highly controlled and secure infrastructure.

IMPORTANT DISCLAIMERS:

The author’s point of view reflected in this article should not be construed as investment advice. The CTA strategies noted herein, some of which may be available on the Galaxy Plus platform, do not represent an endorsement of a particular CTA or strategy. The information presented is for illustrative purposes only and is based on the opinion of the author as a result of recent market conditions and does not represent the view of New Hyde Park Alternative Funds, LLC.

AN INVESTMENT IN ANY FUND IS SPECULATIVE AND INVOLVES A HIGH DEGREE OF RISK. THE PAST RESULTS OF A FUND AND/OR ITS TRADING ADVISOR ARE NOT INDICATIVE OF HOW SUCH FUND WILL PERFORM IN THE FUTURE. 3476-NHPAF-07182024